Online Loans: Now Simpler to obtain

The unlimited realm of the internet(World wide web) today offers every service imaginable. From buying clothes online to purchasing cars and property online, the web has not really left anything from its ambit, not really loan and insurance services. Yes, it’s the twenty-first century and with the aid of internet it’s possible that you should get yourself a loan relaxing in enhanced comfort of your house.

Common understanding states the information boom has facilitated convergence of great interest rates around the world- approximately it seems. While at first glance, the eye rates offered for diverse loans by numerous banks look homogenous but actually they’re frequently very disparate! The eye you get in your deposits with banks or even the rates of interest relevant on several types of loans will vary in various banks. Think of the arduous task of going a financial institution individually before you decide to finalize on where to gain access to credit. The cool thing is that you’ll be made confused and not able to seize the best offer.

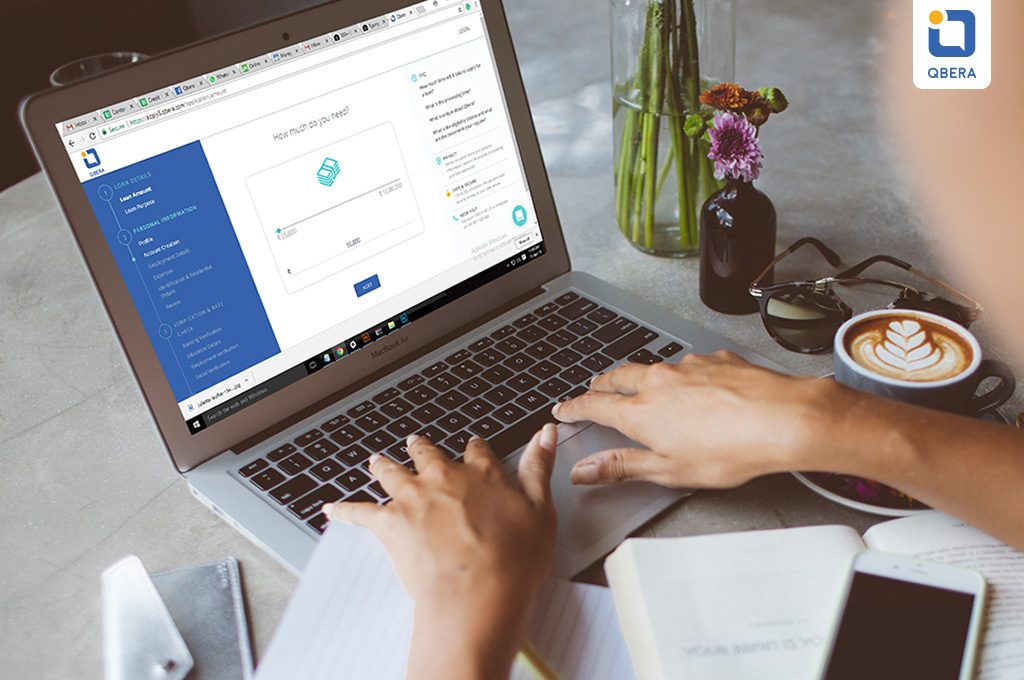

To beat these complexities, online portals like Bank Bazaar, Fundera etc happen to be created. What exactly do these web based loan marketplaces do? They permit prospective borrowers to buy loans much like they’re buying their other activities online! They empower you, the customer, to use to multiple banks using the mouse click, making the whole process easy and straight forward.

The borrowed funds intermediaries discussed above focus on salaried people and established companies getting a stable earnings stream and individuals in a position to furnish proofs. What about borrowers that aren’t offered by such banks? How about individuals business startups who’ve a rather faulty credit rating and moderate repayment capacity but show an encouraging future? Or SMEs which lack collateral and therefore are thus not able to convince banks to give loan to them?

This is when the Non Banking Financial Institutions (NBFCs) enter into the image, making the markets more inclusive and tolerant. NBFCs don’t hold banking licenses and don’t provide checking facilities. Nevertheless, they’re indispensable to credit markets because they are instrumental for bridging the loan unavailability void produced by traditional lenders. NBFCs are recognized to assume and the higher chances and therefore are frequently more flexible to the requirements of their customers.

But approaching every person non loan provider is really as strenuous and back-breaking as visiting each bank one at a time. This is when online platforms for acquiring financing part of- making the whole loan acquiring procedure smooth and simple. So all you need to do is register your company and financial requirement using the online platforms- choose a summary of lenders you need to provide your data to- receive multiple loan offers from selected lenders & finally grab the best offer.

Why rely on these web based loan intermediaries to complete your work? The reply is intuitive- they save you plenty of inconvenience making acquiring funds for the business challenging-free affair. In addition, they release lots of your energy, thus enabling you to concentrate on building and expanding your company.

Comments are closed.